The latest version of SAP S/4HANA Cloud, Public Edition 2302, brings a range of updates to enhance the scope of financial management. Here are some key features that stand out:

Streamlining ESG Data Collection

The new Group Reporting Data Collections package offers ready-to-use forms for capturing ESG (environmental, social, corporate governance) metrics. These forms are designed in accordance with GRI and WEF SCM standards, making data collection quick and straightforward. The forms cover key ESG areas, including greenhouse gas emissions, energy consumption, water usage and withdrawal, personnel diversity and inclusion, discrimination cases, anti-corruption training, and research and development project descriptions.

Value Proposition: The sample forms streamline the process of creating your own ESG data collection forms. They enable easy collection of ESG data from entities along with consolidation figures and allow for extension of data entry forms for additional ESG metrics.

Capabilities: You can use the sample data entry forms as they are or configure them to suit your specific ESG data entry requirements. These forms support ESG metrics (statistical FSIs), comments, and visual controls.

Flexible Configuration of Parallel Ledgers

SAP S/4HANA Cloud now provides flexibility in setting up and configuring parallel ledgers, based on the accounting principles and the nature of your business operations. This feature is particularly beneficial for companies operating in multiple countries, needing to comply with different accounting standards.

Value Proposition: The platform allows for consistent parallel use of full standard ledgers, configurable to meet the needs of different accounting standards. It provides a complete audit trail for each ledger separately and offers flexible assignment of accounting principles to ledgers at both corporate and company-code levels.

Capabilities: The system supports the use of up to three parallel standard ledgers and allows ledger-based configuration of critical settings, such as currencies, accounting standards, and fiscal year variant settings.

Mass Uploading of Customer Open Items

The Upload Customer Open Items app allows for bulk upload of multiple customer open items at once. Once uploaded, you can check and post the customer open items from this app, streamlining the process and increasing efficiency.

Value Proposition: This feature enhances flexibility in creating customer open items like customer invoices and increases the efficiency of checking and posting with the use of application jobs.

Capabilities: The app enables mass uploading of customer open items, such as customer invoices and credit memos. You can edit, check for errors, and post customer open items in batch within the app.

Expanded Posting Periods

SAP S/4HANA Cloud now supports up to 16 posting periods for your fiscal years, providing increased periodicity for your accounting and reporting. This feature is particularly useful in industries requiring more than 12 posting periods for their fiscal year.

Value Proposition: The platform offers a configurable template for defining your fiscal year variant, high flexibility in terms of the number of posting periods, and is based on the robust Universal Parallel Accounting architecture.

Capabilities: The configurable template supports up to 16 posting periods, allowing for fiscal year variants containing more than 12 posting periods.

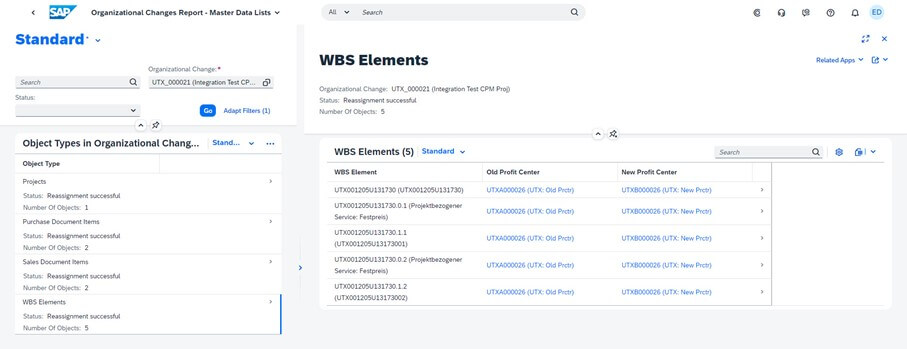

Organizational Flexibility in Financial Accounting for Cloud EPPM Projects

The Manage Organizational Changes app now supports the reorganization of profit centers for enterprise projects, ensuring consistency and accuracy in business operational processes.

Value Proposition: This feature provides transparency to stakeholders involved in the reorganization and allows companies to easily adapt to internal and external changes in controlling structures and reporting.

Capabilities: The solution enables planning, simulation, and performance of organizational changes. It also provides analytical reporting apps for checking object dependencies, the status of profit center reassignments, and analyzing the impact on financial data after

Bank Statement Monitoring Made Easy

The new Bank Statement Monitor app lets you keep an eye on the status of end-of-day bank statements for individual bank accounts. Not only can you check the status of a specific date’s end-of-day bank statements, but you also get a 14-day overview starting from the date you selected. This efficient tool helps to identify problematic bank statements and track any missing statement page, discrepancies between the bank statement balance and the G/L account balance, or any items that have not been posted.

Value Proposition: The Bank Statement Monitor serves as a central place for bank statement monitoring, enabling immediate identification of bank statement issues.

Capabilities: The app allows you to display a list of bank accounts selected for monitoring based on filter criteria, view different statuses of end-of-day bank statements, switch between single-day and 14-day views, refresh monitoring results, and navigate to related apps.

Integrating Promise-to-Pay Documents as Payment Advice

In the processing of bank statement items or lockbox items, you can now utilize promises to pay to search for matching open items. This feature allows automatic closure of a promise to pay that you’ve used to post and clear your items.

Value Proposition: This feature increases automation, reduces the effort to request remittance information from the customer, and eliminates redundant data storage for the same payment.

Capabilities: You can use the PROM processing instruction in the Reprocess Bank Statement Items or Reprocess Lockbox Items apps for manual processing. You can also use the PROM processing instruction in automated rules in the Manage Processing Rules app for automatic processing. The PROM processing instruction searches for promises to pay for the respective customer and company code and automatically closes promises to pay after the payment is processed.

Managing Substitution and Validation Rules for Asset Master Data

With the new SAP Fiori App, you can manage substitution and validation rules for asset master data, providing enhanced flexibility in asset accounting business processes.

Value Proposition: This tool safeguards your business processes by prefilling values in the fixed asset master data record or by validating user entries. It allows you to enhance the existing standard logic per asset class according to your specific requirements without configuration and enrich custom extension fields with custom logic.

Capabilities: You can implement custom substitution and validation rules for asset master records. These rules can be defined by you (no code) or implemented using your own algorithms via the SAP S/4HANA Cloud ABAP Environment (low code).

In summary, the latest SAP S/4HANA Cloud, Public Edition 2302, is a significant step forward for finance professionals seeking efficiency, flexibility, and control. From building forms for ESG data collection, managing parallel ledgers, and mass uploading of customer open items, to more flexible fiscal year settings and organizational changes in financial accounting for cloud EPPM projects, this update is designed to meet the evolving needs of businesses. Further, features such as the new Bank Statement Monitor, the integration of promise-to-pay documents as payment advice, and the management of substitution and validation rules for asset master data emphasize the focus on enhancing user experience and operational effectiveness. SAP continues to pave the way for digital transformation in the finance sector, helping businesses navigate the complexities of today’s financial landscape with ease and precision.